Bir Form 2316 Philippines

Amendments to the Mandatory Submission of SAWT, MAP, BIR Form No. BIR Form N. 2. 31. RR No. 2 2. 01. 5 Content. Amendments to the Mandatory Submission of SAWT, MAP, BIR Form No. BIR Form N. 2. 31. RR No. 2 2. 01. 5The Bureau of Internal Revenue BIR recently issued Revenue Regulations RR No. RR No. 2 2. 00. 6 and No. BIR Form Nos. 2. 30. The provisions of Section 2. D. of RR No. 2 2. Section 2. Mandatory Submission of Summary Alphalist of Withholding Agents of Income Payments Subjected To Creditable Withholding Taxes SAWT by the PayeeIncome Recipient and of Monthly Alphalist of Payees MAP Subjected to Withholding Tax by the Withholding AgentIncome Payor as attachment to their filed returns. D. Return required to be filed with SAWT and Certificate of Creditable Tax Withheld at Source. Get software and technology solutions from QuickBooks, the leader in business applications. Run simple with IT solutions. Avail now Philippines. Under the low downpayment plans, you only have to pay as low as P33,000 downpayment to drive home your dream car Click for more detailsProvided, however, that the SAWT shall be submitted through the applicable modes of submission prescribed under RR No. BIR. On the other hand, in lieu of the submission of hard copies of Certificate of Creditable Tax Withheld at Source BIR Form No. SAWT, the following procedures shall be strictly obeserved 1. Scan the original copies of BIR Form No. Store the soft copies of BIR Form No. PDF file format with the file names alphabetically arranged in a Digital Versatile Disk Recordable DVR R. The file name shall contain the following information separated by an underline a. BIR registered name of the taxpayer payor b. Taxpayer Identification Number TIN, including the head office code or branch of the payor, whichever is applicable andc. Taxable Period. 1. Example Rizal Mfg. Corp1. 31. 88. 52. Bir Form 2316 Philippines' title='Bir Form 2316 Philippines' /> Label the DVD R containing the soft copies of the said BIR forms in accordance with the format prescribed in Annex A of these Regulations and. Submit the duly accomplished DVR R to the BIR Office where the taxpayer is duly registered, together with a notarized Certification, using the format in Annex C of these Regulations, duly signed by the authorized representative of the taxpayer certifying that the soft copies of the said BIR form contained in the DVD R are the complete and exact copies of the original thereof. Please refer PDF File of the full text of Revenue Regulations No. Bir Form 2316 Philippines' title='Bir Form 2316 Philippines' />

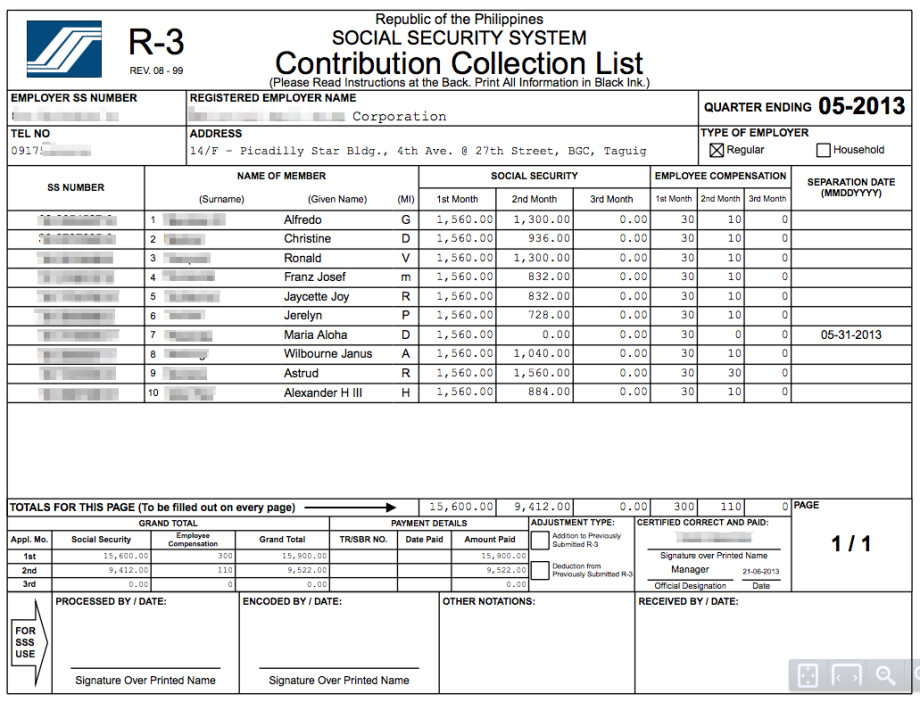

Label the DVD R containing the soft copies of the said BIR forms in accordance with the format prescribed in Annex A of these Regulations and. Submit the duly accomplished DVR R to the BIR Office where the taxpayer is duly registered, together with a notarized Certification, using the format in Annex C of these Regulations, duly signed by the authorized representative of the taxpayer certifying that the soft copies of the said BIR form contained in the DVD R are the complete and exact copies of the original thereof. Please refer PDF File of the full text of Revenue Regulations No. Bir Form 2316 Philippines' title='Bir Form 2316 Philippines' /> Amendments to the Mandatory Submission of SAWT, MAP, BIR Form No. BIR Form N. 2316 under RR No. Whatsapp For Pc Windows Xp Without Bluestacks For Pc there. The Bureau of Internal Revenue BIR recently issued. Philippines Payroll Processing Services Payroll Computation. Configuring pay code taxability per employee, whether they are single or married, names of dependents.

Amendments to the Mandatory Submission of SAWT, MAP, BIR Form No. BIR Form N. 2316 under RR No. Whatsapp For Pc Windows Xp Without Bluestacks For Pc there. The Bureau of Internal Revenue BIR recently issued. Philippines Payroll Processing Services Payroll Computation. Configuring pay code taxability per employee, whether they are single or married, names of dependents.